This is a follow-up to the previous article – Primary Market Manipulation - An Emerging Surveillance Risk. That report created a lot of interest and discussion, particularly around the theme of pre-hedging. Those discussions justified a follow-up to provoke further useful discussion on this important topic.

Broader Issues

Whilst the previous article spoke of market manipulation related to primary

market activity, the problem actually relates to a wider set of problems: those

of all financial market transactions where a private fixing is involved.

In this case, the term private fixing relates to any case where a transfer of

risk off-exchange takes place between parties at a price determined by

reference to a screen price. The screen will display prices where market

participants are willing to trade. For example, as described in Commodity

Futures Trading Commission (CFTC) vs John Patrick Gorman III, a bond

issuance and issuer swap were priced using the ‘19901’ screen, which

displayed prices from a SEF (Swap Execution Facility) Broker Firm, including

prices for U.S. dollar interest rate swap spreads with a ten-year maturity

(“Ten-Year Swap Spreads”).

We described enforcement cases related to the fixed income and FX markets

in all cases where a screen fixing was used to determine a risk transfer

price between parties. However, the commodity and equity markets also

feature trades conducted on the same basis. Whilst enforcement cases

may not have featured in these markets, the same problems will almost

certainly exist.

Risk Assessment

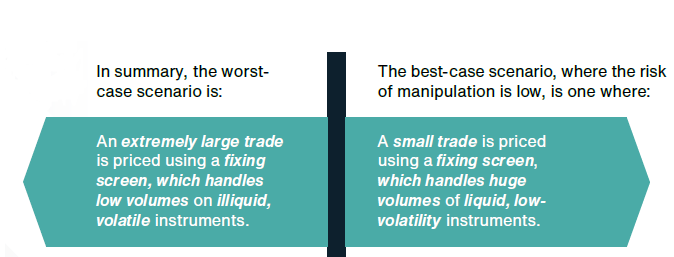

Expressed as a general principle, the problem arises when a large volume

of risk is priced over the counter with reference to a screen, where the

contemporaneous volumes may be much lower. The issue is particularly

acute where the reference instrument (i.e., the instrument whose price is

displayed on the screen) generally trades in low volume and whose price

is volatile.

To some extent, we can break the problem down into two separate

components: those of pre-hedging and disclosure and those of market

manipulation.

Pre-Hedging

It seems logical that, when agreeing to a very large, risky trade with a

customer, two possible approaches to pricing can be taken.

1. The customer assumes the execution risk. In this case, the bank

performs all the required hedges and passes on the weighted average

price to the customer, plus an agreed profit margin. In this case, the

question of pre-hedging is not a relevant one; the actual execution

prices of the hedge trade achieved by the bank are simply passed on to

the customer and no screen price needs to be referenced.

2. The bank assumes the execution risk. In this case, the agreed trade

price includes a premium that the bank charges in exchange for

assuming the entire execution risk (the risk that the market moves

against the bank before the hedging can be completed). In this case, it

seems reasonable that pre-hedging would not be allowed since the bank

is explicitly charging a premium for assuming the risk that pre-hedging

negates. Additionally, pre-hedging is likely to cause the price of the

reference instrument to move against the customer, thus prejudicing the

customer’s interests.

Both options 1 and 2 seem reasonable. However, it seems that it would

be unreasonable to agree to option 2 with a customer, quote a full-risk

transfer price and then engage in pre-hedging. Charging a full transfer

price (in exchange for all the execution risk) and mitigating that risk by

pre-hedging (and in doing so, possibly disadvantaging the customer) seem

incompatible.

Whilst such an action isn’t necessarily market abuse, it seems dishonest

and possibly fraudulent. In its accusations against Westpac, ASIC

(Australian Securities and Investment Commission) labels the behaviour

“unconscionable conduct”. Additionally, within the ‘ESMA (European

Securities and Markets Authority) Evidence on pre-hedging’ published July

2023, ESMA finds insufficient evidence to ban the practice of pre-hedging

outright but concludes "that pre-hedging… might give rise to conflicts of

interest or abusive behaviours”.

Additionally, in both cases, but particularly with option 1, there is a risk of

over-facilitation by the executing trader. This is essentially front running;

just before executing the hedge / pre-hedge trades, the trader executes

trades for his own account in the knowledge the large amount of risk

associated with hedging the client trades will impact the market price and

profit the own-book trades.

Many banks have a pre-agreed right to pre-hedge stated in various

disclosure documents provided to their customers. Whilst that might help,

there is undoubtedly a disclosure issue at play which needs to be thought

through carefully on a case-by-case basis. For example, in Mizuho Capital

Markets LLC enforcement action brought by the CFTC, Mizuho would

pre-disclose to its client that it “may” seek to pre-hedge transactions

and that pre-hedging “may” affect the price of the underlying asset, but

Mizuho did not specify to clients that it might engage in trading in the

“minutes or seconds” before execution. The CFTC found that trading FX

spot in this manner allowed Mizuho to hedge its spot exposure at a more

favourable rate than would have otherwise been available. This resulted in

counterparties obtaining less favourable exchange rates on the forward

transactions at issue.

The CFTC found that Mizuho’s failure to disclose its pre-hedging activity

with sufficient specificity violated Section 4s(h)(3)(B)(ii) of the Commodity

Exchange Act (CEA) and 17 C.F.R. §23.431(a)(3)(ii), which requires swap dealers

to disclose “[a]ny compensation or other incentive from any source other

than the counterparty that the swap dealer or major swap participant may

receive in connection with the swap.” The CFTC explained that because

Mizuho had an incentive to trade in the minutes or seconds before the

transaction to obtain a more favourable spot rate on its pre-hedges, which

could negatively affect the rate its clients would receive on the transaction,

Mizuho had a conflict of interest that needed to be adequately disclosed.

Based on the alleged inadequacy of the disclosure, the CFTC also charged

Mizuho with violations of Section 4s(h)(3)(C) of the CEA and 17 C.F.R.

§23.433, which requires that swap dealers “communicate in a fair and

balanced manner based on principles of fair dealing and good faith,” and

with a failure to supervise under Section 4s(h)(1)(B) of the CEA and 17

C.F.R. §23.602(a) based on alleged shortcomings in Mizuho’s policies and

procedures related to its pre-hedging practices.

Similarly in the CME (Chicago Mercantile Exchange) NOTICE OF

DISCIPLINARY ACTION - COMEX 19-1158-BC, dated 19 May 2022,

against J. Aron & Company LLC, the CME noted ‘A party acting principally

in a block trade negotiation that plans on engaging in pre-hedging

activity must ensure it is clear to its counterparty that the party is trading

principally and, as such, owes no agency duties to the counterparty. In that

regard, initial disclosures in account opening agreements or other similar

communications may be deemed insufficient in the event that the block

trade negotiation itself is indicative of the party assuming agency duties to

the counterparty.’

Market Manipulation

It might be possible to argue that pre-hedging is permitted even when the

customer trade is executed at a price which references a screen price.

However, regulators are clear that such permission does not create a

licence to manipulate market prices.

Pre-hedging activity in this case should be executed in such a manner as

to create minimal market impact. Recklessly creating market impact by

executing large trade volumes just before the screen price is referenced

is likely to constitute market abuse both with and without pre-hedging

rights. Indeed, it seems reasonable that traders' pre-hedging transactions

have a general responsibility to create minimal market impact ahead of

private fixings. For example, the FICC Markets Standards Board, “Standard

for Execution of Large Trades in FICC Markets,” notes that “Pre-hedging

should be reasonable relative to the size and nature of the anticipated

transaction.”

The amount of pre-hedging and the hedging mechanism employed to

avoid unfair market impact and the risk of creating a false or misleading

impression of the market price is extremely nuanced and will depend upon

the market and the circumstances. This has been highlighted by bodies

such as the Global Foreign Exchange Committee within the FX Global

Code where they note that in assessing whether pre-hedging is being

undertaken in accordance with the principles outlined within the Code, a

“Market Participant should consider prevailing market conditions (such as

liquidity) and the size and nature of the anticipated transaction.”

Regulatory Scrutiny

The regulatory complaints and prosecutions brought by various global

regulators clearly indicate that there is significant concern that primary

market transactions are not systematically monitored for market abuse and

customer conflicts of interest.

In many banks, primary market transactions are monitored on a random

selection basis. Selected transactions undergo a “deep dive” where

communications associated with the trading activity are analysed and, in

some cases, the hedge trades themselves are analysed.

This approach is unlikely to be acceptable to regulators and the

recent enforcement cases make clear that this is an area of increased

regulatory focus.

The first article in the series, Primary Market Manipulation - An Emerging Surveillance Risk, is available to read now.

We have recently published an update regarding Pre-Hedging, which is now available to read - Pre-Hedging: IOSCO's New Guidance and the Evolution of Trade Surveillance.

-4.png?length=1440&upsize=true&upscale=true&name=MicrosoftTeams-image%20(5)-4.png)