TradingHub recognises that trade surveillance in fixed income markets presents unique challenges. To understand why, we must first identify how fixed income

markets differ from equity markets.

Crucially, whilst most companies possess only one type of common equity, they have many individual bond issuances. There are a variety of bond issues resulting from companies borrowing varying sums of money at varying times and market conditions.

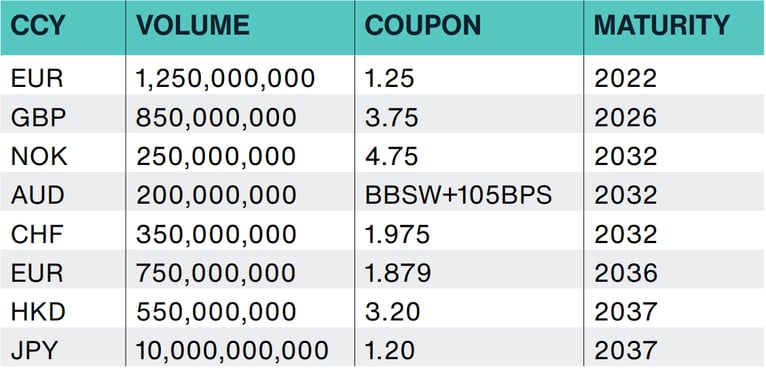

For example, a company like Vodafone (VOD) has 57 individual bond issuances. The list below details how they span across multiple currencies, maturities, rates and more.

Exhibit 1 - A selection of VOD bond issuances across currencies, maturities and rates

The result of the above is that fixed income investors must focus on inventory/portfolio management to a far greater extent than their peers in other asset classes. Consider the likelihood of a buyer and seller of the same common equity to present at the same time. Now, consider an identical situation but in the context of an individual bond. The likelihood plummets: this is a critical difference that has led to divergence in market development.

The high probability of simultaneous buyers and sellers in equity markets has driven flow towards electronic venues. In this environment, the key differentiator has become the speed of execution. As a result, banks focus on providing Direct

Market Access (DMA) and potentially abusive behaviour often consists of order book manipulation and short-term momentum strategies.

Inventory management differs radically in fixed income markets, where banks must continue to act as principal. Where standardisation does emerge in fixed income, it is often to address the risk management hurdles faced by market-makers. For example, highly liquid bond futures and credit index markets provide useful proxy hedges for inventory management (they also serve the dual purpose of providing low-cost instruments for speculation).

In this environment, fixed income market-makers are managing the risk in their books as a whole. They lay-off risk from inventory changes by using bond futures (for interest rate risk) and CDX / iTraxx indices (for credit risk). Furthermore, they manage the risk of customer flow arising from the swaps market in a similar way.

Such behaviour presents the trade surveillance world with unique challenges that cannot be bolted on to legacy systems as an afterthought. There are significant pitfalls in the way these surveillance tools, originating from equity markets, fail to

understand the hedging activity and risk management in fixed income. TradingHub’s approach extends beyond the limits of these solutions.

Why cross-asset detection is the missing piece

In order to think about cross-asset abuse, we must first acknowledge the way fixed income participants manage their investments using a variety of correlated products. If we accept that two fixed income securities display sufficient price

correlation to act as effective hedges for each other, then it is an obvious extension that they can be used in concert to conduct market abuse. For example, aggressive sell orders for bond futures can be used to push down the price of similar treasuries.

The scale of the challenge is enormous: every single bond from government to corporate and every single product from bond futures to swaptions are expressions of interest rate risk. This means they will manifest significant correlation in their price evolution, prompting the question: how can you tame such complexity? The solutions provided by other vendors are not sustainable. They ask customers to maintain pairwise mappings of correlated instruments. Not only is this infeasible to maintain, but it would also not extend into the OTC derivative space.

A better solution is to model the fixed income trade flow in a way that is compatible with how the market-maker is riskmanaging their portfolio. This approach is more sustainable at addressing the challenge directly.

When buying a 50mm USD of a 30Y bond, a fixed income trader will be somewhat concerned with the particulars of the ISIN in question, but will be much more likely to be thinking in terms of the broader position in the fund:

Answering these questions informs how aggressively the trader prices the bond, and what (if any), hedging strategies are needed to manage the risk of the purchase.

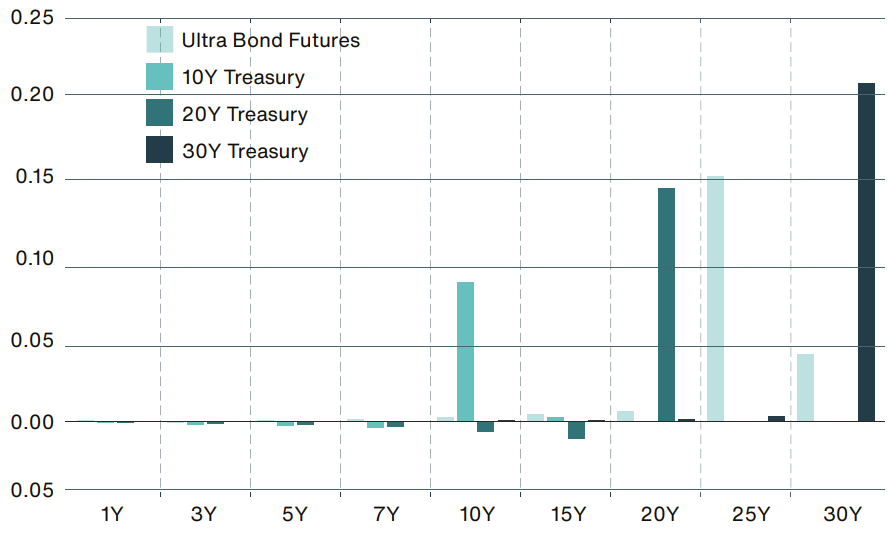

Exhibit 2 - Bucketed DV01s for various treasury securities

It is clear that the only way to effectively model a fixed income trader is to monitor their position through the perspective of financial market Greeks. To elaborate, Greeks are the exact techniques explicitly used by derivative market-makers to

manage similar risks.

Fixed income Greeks (particularly DV01s and CS01s), can be used to measure the sensitivity of any fixed income transaction (whether a bond, swap, swaption, future, option) to perturbations in the interest rate environment and to the credit

worthiness of a bond issuer. In doing so, these Greeks allow the trader to forget about the precise particulars of the trade in question and instead focus on the risk it represents. When applied to bonds, these techniques allow us to understand that

the risk in buying a 30Yr bond largely overlaps with the risk expressed in purchasing an ultra bond future or in receiving fixed in a 25Yr Swap. The Greeks perspective eradicates the unhelpful particulars of a transaction and pinpoints our focus on the view that the transaction is facilitating.

Greeks and beyond

Greeks represent the first and fundamental elements of a riskbased approach to surveil fixed income markets. They are the necessary first step – allowing us to see that similarly unrelated transactions, can be expressions of a common view, and can therefore be used in tandem in abusive trading patterns.

Understanding this, what comes next in building a surveillance function that effectively surveils cross-asset abuse within fixed income markets? Questions that arise are:

Answering these questions requires a framework which not only aggregates risk exposure by Greeks, but also understands both the fundamental dynamics of how prices evolve within the market and how market prices are impacted by technical

mismatches in supply and demand.

Nevertheless, even this first step in modelling helps express how TradingHub’s approach can be brought to bear on regulatory scrutiny on cross-asset abuse.

In Part 2 of this series, we will continue exploring the modelling journey, which will cover 'General Market Modelling' and 'Market Impact Modelling' as necessary additional steps for fixed income surveillance.

.png?length=1440&upsize=true&upscale=true&name=MicrosoftTeams-image%20(4).png)