Trade surveillance is facing significant challenges due to its traditional reliance on single venue monitoring and an over-reliance on the indicators of manipulative behaviour from the annexe to the ESMA guidance for MAR. Moreover, such frameworks lack compatibility with fundamental techniques in banks’ market-making and risk management teams. The result is a trade surveillance industry ill-equipped to mitigate the risks of cross-product abuse and bearing the significant costs of an over-abundance of false positives. To address these issues, it is essential to examine the fundamental aspects of trade surveillance, including how banks' trading desks make money and the primary legislation governing market abuse.

How do trading desks make money?

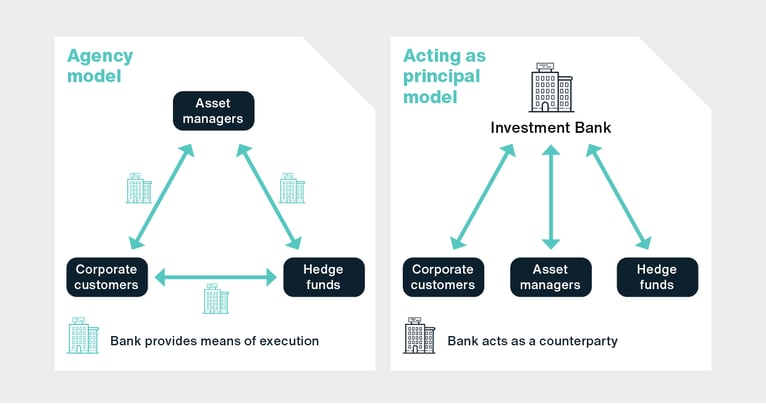

To understand how traders may manipulate or abuse markets, it is important first to understand their business models. This means looking at how they operate within financial markets day-to-day to make money. Banks typically offer both agency and principal trade execution services to their customers. Under an agency model, banks provide a means of execution for customers: they facilitate the trade execution without taking any market risk on the transaction themselves. They effectively buy or sell on behalf of their customers on a perfectly matched basis. This is not a high-margin business, instead the customer pays a fee for the service provided. The model can be seen across different asset classes but is particularly prevalent in very liquid securities such as cash equities. Alongside an agency model, banks also provide trade execution services for customers on a principal basis. Under this model, the market-maker will provide a ‘risk price’ to the customer

and, if executed, the trader bears the market risk of the trade. Trading as principal is typically required where customers either need to trade a large size of a liquid security, or any size of a less liquid security or derivative. The rationale here is that it is either impossible to source the risk for the customer on a perfectly matched basis, or doing so would involve excessive execution costs (i.e., market impact).

Acting as principal to a trade also allows banks to offer customers exactly what they want in terms of a bespoke structure of a trade. For example, a customer may want to hedge the interest rate risk in a loan they are agreeing today, though it will drawdown in 3 months’ time, and then be repaid over time to create an amortising schedule. There is no standard existing product that perfectly hedges this risk, but an interest rate swap trader is still able to structure a hedge that mirrors the profile of the loan and hedges the customer’s interest rate risk. However, in doing so the trader will take on the bespoke market risk of the trade themselves. They are compensated for this with a margin they receive on the trade which will scale proportionally to the size and complexity of the market risk they take on and the illiquidity of that risk.

While banks are in the business of taking and warehousing risk, market-making businesses will generally look to hedge the majority of the market risk they take on when acting as principal. The question is how do they manage this when hedging the risk on a perfectly matched basis is either impossible or unprofitable? The answer lies in the fundamental skill of being a principal market-maker; the ability to break risk down into its constituent parts, and determine when and how to hedge them. This requires balancing the execution costs of hedging with the effects of running the market risk, using the margin the customer has paid as a buffer. Marketmakers are able to manage this process while often trading with multiple customers in quick succession. They do this by using mathematical abstractions to understand the market risk they need to hedge, instead of attempting to understand an often vast and constantly moving inventory at the security level. These abstractions are typically modelled as greeks, or sensitivity measures such as DV01 and CS01.

Hedging costs, or execution costs more generally, are typically a function of the liquidity of the security. Thus, one way to minimise the cost of hedging idiosyncratic market risk is to use the most liquid product possible to hedge the required risk. So, in our example above where a trader has provided a customer with a hedge for the interest rate risk of a loan, the trader may use a combination of interest rate futures and bond futures to cheaply hedge the majority of the DV01 of the trade. This fungibility of risk across multiple products is a key concept for principal-based market-making businesses.

It is therefore clear that it is fundamental to the business model of principal market-making for traders to view market risk in terms of DV01s and CS01s, and to trade across a variety of securities, products and venues to manage that market risk. This should in turn shape an understanding of how a trader may abuse or manipulate financial markets. It is essential to consider that the trader may do so across multiple securities, products and venues, in line with how they operate in those markets every day as part of their core business model.

Discussion on legislation and market manipulation - Primary legislation is very high level

Market manipulation and legislation

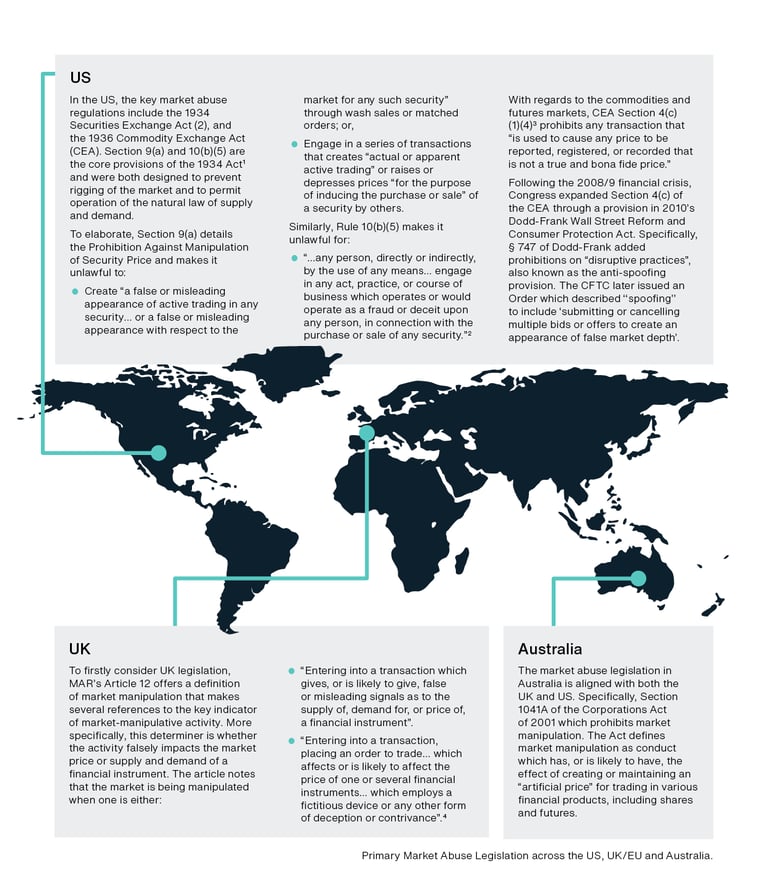

In addition to understanding how traders operate in financial markets, it is important to consider the primary legislation on market abuse. This sheds light on the prohibited behaviours which should be analysed within any trade surveillance solution.

The primary market abuse legislation across the UK/EU (Market Abuse Regulation (MAR)), the US (1933 Securities Act, 1934 Exchange Act, and the 1936 Commodity Exchange Act) and Australia (Corporations Act 2001) share a key tenet. Their definitions of market abuse all contain some reference to entering activity which has a market impact. According to this legislation, the activity must also be executed with the intent of artificially impacting markets and creating a false or misleading appearance, with respect to the market price and/or supply and demand of an instrument.

1. See appendix Item One for more information.

2. See appendix Item Two for more information.

3. See appendix Item Three for more information.

4. See appendix Item Four for more information.

Market manipulation and legislation

The legislation clearly indicates that the key factors in determining activity that constitutes market abuse are impact on the market and affecting the natural supply and demand of a financial instrument. Therefore, it is no surprise that the courts have utilised the same criteria when adjudicating market abuse cases. They have noted that it is acceptable to trade or place orders with the intention of speculation, hedging or of facilitating customer business. However, it is not acceptable to trade with the intention of moving the price (or attempting to move the price) of a financial instrument.

The U.S. Commodity Futures Trading Commission (CFTC) issued an Order filing and simultaneously settling charges against Panther Energy Trading LLC of Red Bank, New Jersey and Michael J. Coscia, for engaging in the disruptive practice of “spoofing”. The CFTC Order required Panther and Coscia to pay a $1.4 million civil monetary penalty and disgorgement of $1.4 million in trading profits. The Court described the conduct prohibited by the Dodd Frank Anti Spoofing Provision:

“In practice, spoofing, like legitimate high-frequency trading, utilizes extremely fast trading strategies. It differs from legitimate trading, however, in that it can be employed to artificially move the market price of a stock or commodity up and down, instead of taking advantage of natural market events”. 5

The SEC have interpreted spoofing in a similar way: in SEC v. Lek Sec. Corp., the defendants were charged with § 10(b) violations for engaging in a layering scheme involving the placing of allegedly “non-bona fide orders” with the “intent of injecting false information into the market about supply or demand” for certain stocks. Southern District of New York noted:

“[Market manipulation] broadly includes those practices “that are intended to mislead investors by artificially affecting market activity.” 6

Interpretations of what constitutes market manipulation have risen to the Supreme Court in the US. In Ernst & Ernst v. Hochfelder, the Court held that market manipulation is “virtually a term of art . . . [and] refers generally to practices, such as wash sales, matched orders, or rigged prices, that are intended to mislead investors by artificially affecting market activity.” The Supreme Court has explained that, in other words, manipulative conduct is conduct that “control[s] or artificially affect[s] the price of securities.”

Intent is the most critical part

Whilst § (10)(b)(5) prohibits “conduct involving manipulation or deception”, regulatory concern does not lie with how such manipulation or deception is achieved. The scope of regulation focuses on whether the activity was carried out with scienter i.e., intent. The Supreme Court’s definition of “scienter” in Ernst & Ernst v. Hochfelder illuminates how it manifests as “a mental state embracing intent to deceive, manipulate, or defraud.” Manipulation under §10(b)(5) thus connotes intentional or wilful conduct designed to deceive or defraud investors by controlling or artificially affecting the price of securities.

Since almost the entirety of market activity affects prices in some way, the central question then becomes: what activity affects the price of a security artificially and in a deceptive manner? The majority approach must demonstrate that an alleged manipulator engaged in market activity aimed at deceiving investors. This deception is making them believe that the prices at which they purchase and sell securities are determined by the natural interplay of supply and demand, not rigged by manipulators.

Our examination has highlighted how primary legislation:

It is reasonable to summarise primary legislation as allowing banks to trade to build a position for themselves (i.e. take risk) or to facilitate a customer trade, but they are not allowed to trade with the single aim of moving the price.

This would seem to provide clear direction for building an effective trade surveillance solution. Such a solution would focus on how a trader’s behaviour impacts the market and if there is mitigating context around that market impact, i.e., whether the intent was to build a position or facilitate a customer trade.

In light of the arguments put forward above, why has traditional trade surveillance not followed such clear direction?

In Part Two of this series, we will dive further into the mismatch that exists between what the legislation says and how the courts have interpreted it – and how traditional trade surveillance has not followed their direction. We will also provide an analysis of the approach we have taken at TradingHub.

Knowingly spread false information about a security in order to raise or depress its price and thereby induce the purchase or sale of a security by another.

Item Two

Section 10(b) (15 U.S.C. § 78j)

Section 10(b) (15 U.S.C. § 78j) – Regulation of the Use of Manipulative and Deceptive Devices makes it unlawful to “use or employ, in connection with the purchase or sale of any security registered on a national securities exchange or any security not so registered, or any securities-based swap agreement, any manipulative or deceptive device or contrivance in contravention of such rules and regulations as the Commission may prescribe as necessary or appropriate in the public interest or for the protection of investors.” Eight years after the passage of the ’34 Act, the SEC adopted Rule 10b-5 (17 C.F.R. § 240.10b-5) to refine Section 10(b)’s prohibitions. The rule makes it “unlawful for any person, directly or indirectly, by the use of any means or instrumentality of interstate commerce, or of the mails or of any facility of any national securities exchange,

Item Three

CEA Section 4(c)(1)(4)

CEA Section 4(c)(1)-(4) (7 U.S.C. § 6c(a)(1)-(4) prohibits commodities futures transactions that are “of the character of” “wash” sales, “cross” trades, “accommodation” trades or “fictitious” sales. It also prohibits any transaction that

“is used to cause any price to be reported, registered, or recorded that is not a

true and bona fide price.”

Following the 2008/9 financial crisis, Congress expanded Section 4(c) of the CEA through a provision in 2010’s Dodd-Frank Wall Street Reform and Consumer Protection Act. Specifically, § 747 of DoddFrank added prohibitions on “disruptive

practices” to CEA § 4(c). The new section (7 U.S.C. § 6c(a)(5)) states that it “shall be unlawful for any person to engage in any trading, practice, or conduct on or subject to the rules of a registered entity that—(A) violates bids or offers; (B) demonstrates intentional or reckless disregard for the orderly execution of transactions during the closing period; (C) is, is of the character of, or is commonly

known to the trade as, ‘spoofing’ (bidding or offering with the intent to cancel the

bid or offer before execution).” The CFTC then issued guidance in a proposed

interpretive order which actually defined spoofing. The Proposed Order described

‘‘spoofing’’ to include the following: (i) Submitting or cancelling bids or offers to

overload the quotation system of a registered entity, (ii) submitting or cancelling

bids or offers to delay another person’s execution of trades, and (iii) submitting or

cancelling multiple bids or offers to create an appearance of false market depth.

Item Four

MAR Article 12

MAR Article 15 makes it an offense to engage or attempt to engage in prohibited market manipulation activities. Article 12 defines market manipulation as including:

Item Five

United States v. Coscia, 14-cr-00551, Dkt. #177-21 (N.D. Ill.)

The U.S. Commodity Futures Trading Commission (CFTC) issued an Order filing and simultaneously settling charges against Panther Energy Trading LLC of Red Bank, New Jersey, and Michael J. Coscia, for engaging in the disruptive practice of “spoofing”. The CFTC Order required Panther and Coscia to pay a $1.4 million civil monetary penalty, disgorgement $1.4 million in trading profits.

Additionally, the Securities and Commodities Fraud Section of the U.S. Attorney’s

Office in Chicago brought criminal charges against Coscia. The indictment against Coscia marked the first federal prosecution under the anti-spoofing provision enacted in the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act. Coscia was convicted and sentenced to three years in prison ... This artificial movement is accomplished in a number of ways, although it is most simply realized by placing large and small orders on opposite sides of the market. The small order is placed at a desired price, which is either above or below the current market price, depending on whether the trader wants to buy or sell. If the trader wants to buy, the price on the small batch will be lower than the market price; if the trader wants to sell, the price on the small batch will be higher. Large orders are then placed on the opposite side of the market at prices designed to shift the market toward the price at which the small order was listed.”

Item Six

SEC v. Lek Sec. Corp., et al., 17-cv-01789 (S.D.N.Y. 2017).

The SEC have interpreted spoofing similarly to the CFTC. In SEC v. Lek Sec. Corp., for example, the defendants were charged with § 10(b) violations for engaging in a layering scheme involving the placing of allegedly “non-bona fide orders” with the “intent of injecting false information into the market about supply or demand” for certain stocks. Southern District of New York noted:

[Market manipulation] broadly includes those practices “that are intended to mislead investors by artificially affecting market activity.” In considering whether an act injects false pricing signals into the market, courts recognize that one of the fundamental goals of the federal securities laws is . . . “to prevent practices that impair the function of stock markets in enabling people to buy and sell securities at prices that reflect undistorted (though not necessarily accurate) estimates of the underlying economic value of the securities traded. . . . Market manipulation can be accomplished through otherwise legal means.

Sam Lek and his company settled the SEC’s claims before in exchange for a $1.42 million penalty, disgorgement of $525,892, and a compliance monitor for three years. The remaining defendants were found guilty after trial in November 2019. In March 2020, a final judgment was issued that imposed a nearly $20 million combined penalty.

-1.png?length=1440&upsize=true&upscale=true&name=MicrosoftTeams-image%20(5)-1.png)